Who is a real estate investor?

Real estate investment trusts (REITs) provide indirect real estate exposure without the need to own, operate, or finance properties.

A real estate investment trust (REIT) is a publicly traded company that owns operates or finances income-producing properties.

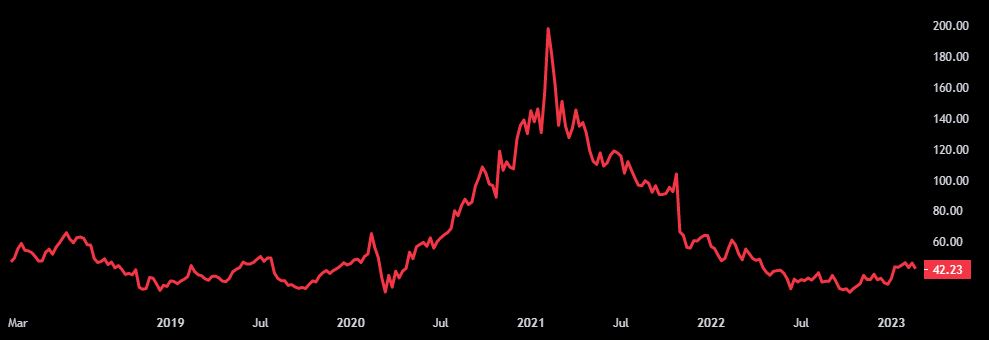

This real estate stock (included in the portfolio) will go through the roof when interest rates fall.

REITs are total return investments. They typically provide high dividends plus the potential for moderate, long-term capital appreciation. Long-term total returns of REIT stocks tend to be similar to those of value stocks and more than the returns of lower-risk bonds.

Historically, REITs’ dividend yields have produced a steady stream of income through various market conditions.

Shares of publicly listed REITs are readily traded on the major stock exchanges.

How is investing in REITs different from buying a residential property?

A house is a consumption good, not an investment, particularly when financed with a sizable mortgage. It does not produce current income but rather requires regular mortgage interest, real estate tax, insurance payments, and maintenance costs.

In contrast, REITs represent an investment in commercial real estate, which generates continuing income flow from rents.

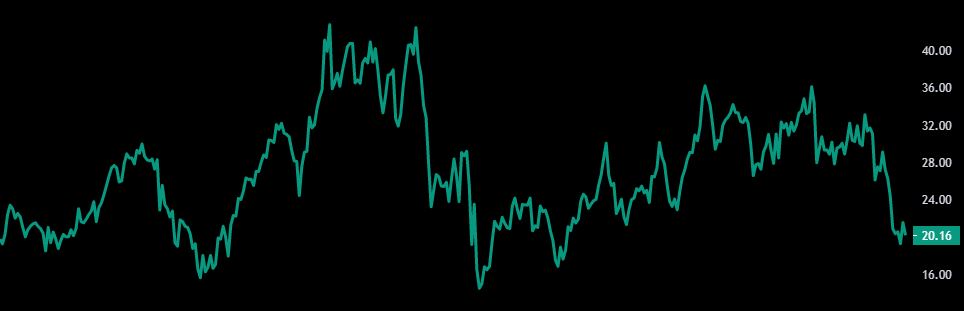

The following healthcare REIT (included in the portfolio) is ready to double your money.

Benefits of investing in REITs

- REITs offer diversification from the stock market since REITs tend to be less volatile than other stocks.

- Because REITs are required to pay 90% of their annual income as shareholder dividends, they consistently offer some of the highest dividend yields in the stock market.

- Returns from REITs can outperform equity indexes.

- Public REITs are highly transparent, including providing audited financial statements.

- Lower cost compared to buying commercial real estate outright.

- Publicly traded REITs are far easier to buy and sell than the laborious process of actually buying, managing, and selling commercial properties.

- REITs tend to be less volatile than traditional stocks because of their larger dividends.

- REITs can act as a hedge against the stomach-churning ups and downs of other asset classes. However, no investment is immune to volatility.

Congress established REITs in the United States in 1960 to give all investors access to income-producing real estate. Since then, the US REIT approach has continued gaining popularity and has served as the model for over 35 countries.

The rise in popularity of UK REITs has been remarkable. The REIT regime came into force on January 1, 2007 and by February 2007 nine of the United Kingdom’s largest listed property companies had converted to REIT status. Fast forward 10 years and there are now more than 70 UK REITs.

The above REIT stock fell significantly in 2022 but still enjoys over 860% growth since its inception in 1999.

Types of REITs

REITs can be of different kinds, including the following:

- Office REITs

- Industrial REITs

- Retail REITS

- Hospitality REITs

- Residential REITs

- Healthcare REITs

- Self-storage REITs

- Data center REITs

- Infrastructure REITs

Portfolio includes:

- 15 carefully selected US REITs to invest in

- Investment strategy

- Rebalancing strategy

- Exit strategy

- Risk factor

- How long should you hold the position to realize maximum gain

- How to buy stocks for investment

- How to open a brokerage account

If you are a Canadian, open an investment/trading account with Questrade and get $50 as a gift.

Apply the following code: 526528465427796

(If you open a Questrade account without a referral code, you get nothing!)

Go to Questrade and open your account.

Once you have opened an account, one of your family members can open an account using your code, and you will earn $50 each. Your $1,000 investment will grow to $1,100 with no stocks bought or sold!

The portfolio shows you how to open an account.

Open a Tax-Free Savings Account (TFSA) so the profit is not taxable.

Happy investing.