Who is a growth investor?

Generally speaking, growth stocks are public companies that are growing their profits, revenue or cash flow at rates well above their competitors and the market at large. – Forbes Advisor.

Growth investing has the following characteristics:

- Growth investing is buying stock in companies with greater growth potential than their industry or the overall market.

- Growth stocks typically fall into two categories – small-cap and innovation companies.

- Small-cap stocks typically have a lower price per share, offering more potential for growth.

- Innovation companies such as technology and healthcare companies bring new products to market space.

- As growth stocks are expected to outperform their peers due to the strong growth potential of the underlying company, they trade at a high price/earnings (P/E) ratio and may be considered overvalued.

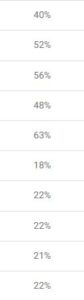

The following image shows the average growth of 10 growth stocks per year in a 3-year period:

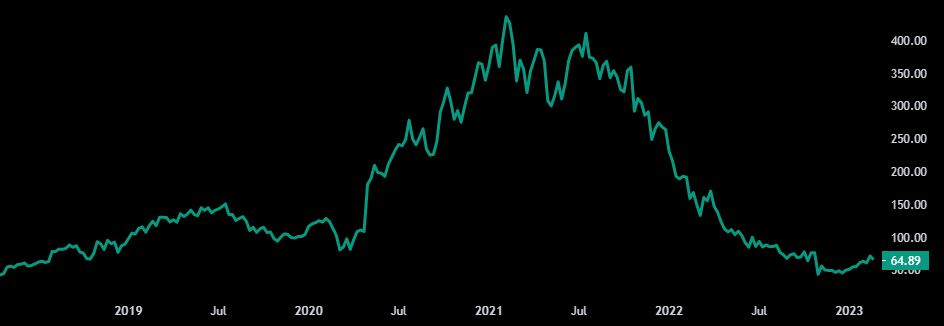

That growth can be monstrous if you consider the following chart.

This stock (included in your portfolio) can potentially return 500% on your investment, if not more.

Invest with Thomas Rowe Price Jr.

Thomas Rowe Price Jr. is considered to be “the father of growth investing.” He spent his formative years struggling with the Depression, and the lesson he learned was not to stay out of stocks but to embrace them.

Other great growth investors include:

- Benjamin Graham

- John Templeton

- Thomas Rowe Price Jr.

- John Neff

- Jesse Livermore

- Peter Lynch

- George Soros

- Warren Buffett

- John (Jack) Bogle

- Carl Icahn

- William H. Gross

Peter Lynch managed the Fidelity Magellan Fund from 1977 to 1990, during which the fund’s assets grew from $18 million to $14 billion.4 More importantly, Lynch reportedly beat the S&P 500 Index benchmark in 11 of those 13 years, achieving an annual average return of 29%.

Portfolio includes:

- 15 carefully selected companies to invest in

- Investment strategy

- Rebalancing strategy

- Exit strategy

- Risk factor

- How long should you hold the position to realize maximum gain

- How to buy stocks for investment

- How to open a brokerage account

If you are a Canadian, open an investment/trading account with Questrade and get $50 as a gift.

Apply the following code: 526528465427796

(If you open a Questrade account without a referral code, you get nothing!)

Go to Questrade and open your account.

Once you have opened an account, one of your family members can open an account using your code, and you will earn $50 each. Your $1,000 investment will grow to $1,100 with no stocks bought or sold!

The portfolio shows you how to open an account.

Open a Tax-Free Savings Account (TFSA) so the profit is not taxable.

Happy investing.