Investing in blue chips

A blue chip is a nationally or internationally recognized, well-established, and financially sound publicly traded company.

Blue chips generally sell high-quality, widely accepted products and services.

A large market capitalization, a listing on a major stock exchange, and a history of reliable growth and dividend payments characterize blue chips.

Blue chip stocks are considered relatively safe investments with a proven track record of success and stable growth.

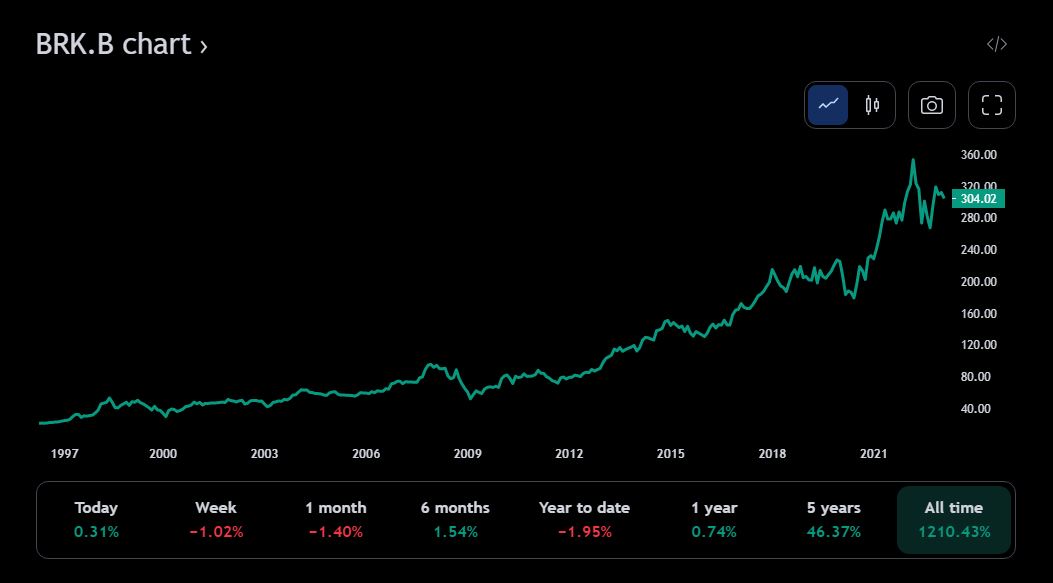

Warren Buffett’s Berkshire Hathaway grew 1210% over the last 35 years. At that rate, an investment of $50,000 would have become $605,000 today.

Investors tend to love blue-chip stocks because the strength of their financial statements means that their passive income from dividends is hardly ever in danger, especially if there is broad diversification in the portfolio.

Blue chip stocks: characteristics:

- Large market capitalization

- Growth history

- Component of a market index

- Dividends

Stocks under this portfolio cover the following sectors:

- Technology

- Industrials

- Finance

- Consumer discretionary

- Healthcare

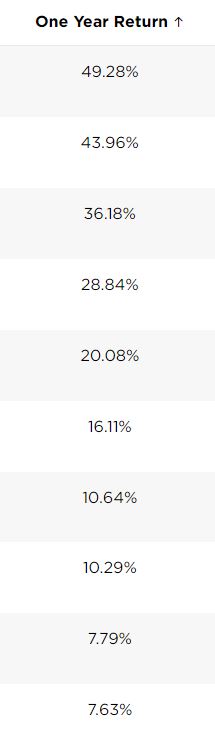

Some of the stocks have seen the following return in the last one year:

Portfolio includes:

- 20 carefully selected blue-chip companies to invest in

- Investment strategy

- Rebalancing strategy

- Exit strategy

- Risk factor

- How long should you hold the position to realize maximum gain

- How to buy stocks for investment

- How to open a brokerage account

If you are a Canadian, open an investment/trading account with Questrade and get $50 as a gift.

Apply the following code: 526528465427796

(If you open a Questrade account without a referral code, you get nothing!)

Go to Questrade and open your account.

Once you have opened an account, one of your family members can open an account using your code, and you will earn $50 each. Your $1,000 investment will grow to $1,100 with no stocks bought or sold!

The portfolio shows you how to open an account.

Open a Tax-Free Savings Account (TFSA) so the profit is not taxable.

Happy investing.