Who is a buy-and-hold investor?

Who wouldn’t want to own Apple Inc. (APPL) when it was trading at $6 per share or Netflix, Inc. (NFLX) at $17?

The buy-and-hold strategy has the following characteristics:

- A buy-and-hold strategy is a long-term, passive strategy in which investors keep a relatively stable portfolio over time, regardless of short-term fluctuations.

- The success of buy and hold has been proven by historical data and is the preferred investing strategy of industry giants such as Warren Buffet.

- Buy-and-hold investors prioritize owning shares of companies with strong business fundamentals.

- Investors are more concerned with how a company performs than with short-term changes in the company’s stock price.

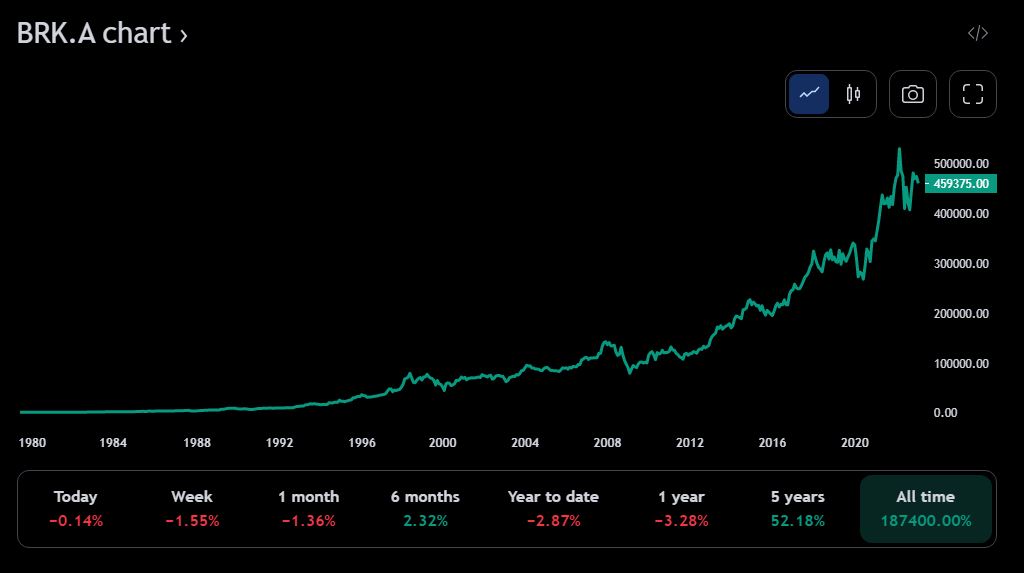

Warren Buffet’s Berkshire Hathway Inc. shares rose from $275 (1980) to $528,000 (2022).

In 1988, Buffett wrote: “When we own portions of outstanding businesses with outstanding managements, our favorite holding period is forever.”

Why a buy-and-hold portfolio is suitable for every investor?

- Buy-and-hold investors don’t need to constantly monitor their investments every hour of every trading day to make buy and sell decisions.

- Since buy-and-hold investing is so simple, there’s very little risk that the strategy will fail due to a tactical error on your part.

- Not selling stocks enables you to avoid owing capital gains taxes on stock sales.

- This strategy also has low brokerage, advisory fees, and sales commissions.

- If you build a portfolio on these strategies, you don’t need much research.

- The passive investing approach reduces what is called “manager risk.” This is the risk that someone takes by actively managing their portfolio.

- Having a more passive strategy reduces the risk of human error.

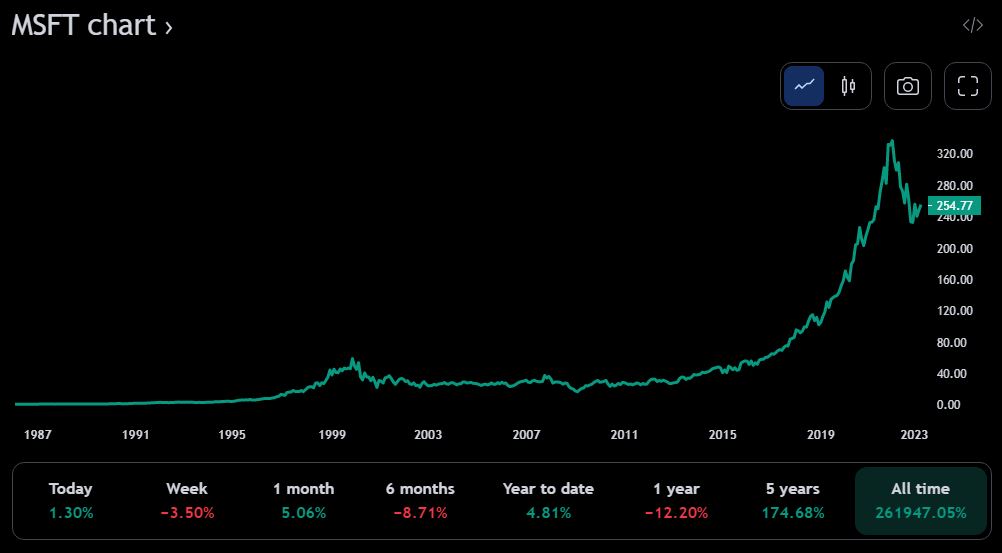

Despite a tech bubble and bust, a financial crash, Covid-19, and the tech crash of 2022, Microsoft stocks rose from a mere $.10 (1987) to over $320.00 in 2022.

That is the power of the buy-and-hold strategy.

Portfolio includes:

- Ten carefully selected companies to invest in

- Investment strategy

- Rebalancing strategy

- Exit strategy

- Risk factor

- How long should you hold the position to realize maximum gain

- How to buy stocks for investment

- How to open a brokerage account

If you are a Canadian, open an investment/trading account with Questrade and get $50 as a gift.

Apply the following code: 526528465427796

(If you open a Questrade account without a referral code, you get nothing!)

Go to Questrade and open your account.

Once you have opened an account, one of your family members can open an account using your code, and you will earn $50 each. Your $1,000 investment will grow to $1,100 with no stocks bought or sold!

The portfolio shows you how to open an account.

Open a Tax-Free Savings Account (TFSA) so the profit is not taxable.

Happy investing.