Who is a concentrated investor?

Despite holding stakes in 49 securities, Buffett and his team have concentrated the company’s investment portfolio in just a few companies.

A whopping 79% of Warren Buffett’s $338 billion portfolio is invested in just six stocks.

- Apple: 41.4%

- Bank of America: 10.8%

- Chevron: 8.1%

- American Express: 8%

- Coca-Cola: 7.1%

- Kraft Heinz: 3.9%

Should you follow Buffett and invest in these companies today?

Probably not. These companies have appreciated over the years and may not bring you the return Buffett has enjoyed.

Under this portfolio, we brought together ten stocks you can invest in today to receive Buffett’s return.

Why concentrate?

According to CFA Institute, from 1999 to 2014, a 10-stock portfolio had a 35% chance of beating the market by 1% or more annually. A 250-stock portfolio had just a 0.2% chance of outperformance.

Investment portfolios that obtain the highest returns for investors are not usually widely diversified. Those with investments concentrated in a few companies or industries are better at building vast wealth.

A concentrated portfolio also enables investors to focus on a manageable number of high-quality investments.

Concentrated investors invest for the long term. The short term is too unpredictable to guess the swings accurately but would increase transaction costs and taxes.

You are not likely to obtain superior results by buying a broad cross-section of the market—the more diversification, the more performance is likely to be average.

The more broadly a portfolio is diversified, the more likely it is to match the performance of the averages. The more concentrated a portfolio becomes, the more likely it is to deviate from those averages.

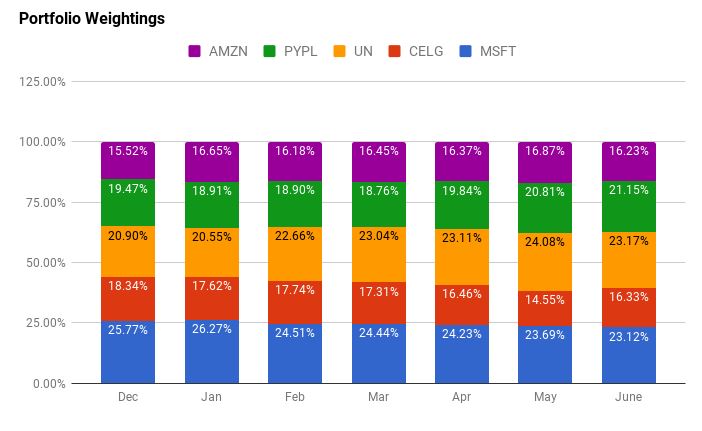

This is how Seeking Alpha allocates its concentrated investment portfolio.

Stocks under this portfolio cover the following sectors:

- Technology

- Industrials

- Finance

- Consumer discretionary

- Energy

Portfolio includes:

- Ten carefully selected companies to invest in

- Investment strategy

- Rebalancing strategy

- Exit strategy

- Risk factor

- How long should you hold the position to realize maximum gain

- How to buy stocks for investment

- How to open a brokerage account

If you are a Canadian, open an investment/trading account with Questrade and get $50 as a gift.

Apply the following code: 526528465427796

(If you open a Questrade account without a referral code, you get nothing!)

Go to Questrade and open your account.

Once you have opened an account, one of your family members can open an account using your code, and you will earn $50 each. Your $1,000 investment will grow to $1,100 with no stocks bought or sold!

The portfolio shows you how to open an account.

Open a Tax-Free Savings Account (TFSA) so the profit is not taxable.

Happy investing.